Massive Open Online Course by Indian Institute of Foreign Trade on

BASICS OF EXPORT - IMPORT

Under Niryat Bandhu Scheme of Ministry of Commerce & Industry, Govt. of India

This session will cover the overall coverage and assessing export readiness like legal definition of exports, who can export, why to export; Inner Qualities required for success in exports, overall understanding of the system for exports;

This session will cover Basic Steps to Export, Export Preliminaries, How to export, Marketing related issues, Where to Export, Pricing and Costing, FTP related issues, WTO Related Issues.

While conducting international business with foreign entities, the firms from various countries complete the documentation formalities by using a common trade classification.

As the tariff barriers on merchandise

products are coming down, newer forms of Non-Tariff barriers (NTBs) are

emerging in the world. Apart from merchandise products, the imports in

service sectors are also subject to interventionist policies by home

countries.

What is an IEC? How to get an IEC online?

How to make changes in IEC?

Major highlights; Incentives for Exports

– Export Promotion Schemes – How to decide on an incentive scheme based

on your business strategy

Indian government has also been in the

process of entering into trade agreements across both developed and

developing markets. In light of various initiatives taken by India

towards signing of regional and bilateral trading agreements, it does

make sense for exporting units to consider diversifying from the

traditional markets of USA, EU and Japan etc to new emerging economies

where India has signed the trade agreement.

Towards making a successful export

transaction, trading companies should be aware about challenges it could

face while entering the importing country which may be beyond just

tariffs. Such challenges which may restrict trade between countries and

are "not tariffs" are termed as "Non Tariff Measures" for example

embargo, import prohibition, regulations, certifications, stringent

quality standards etc.

A business plan is a formal statement of

business goals, reasons they are attainable, and plans for reaching

them. It also contains background information about the organization or

team attempting to reach those goals. Written business plans are often

required to obtain a bank loan or other financing.

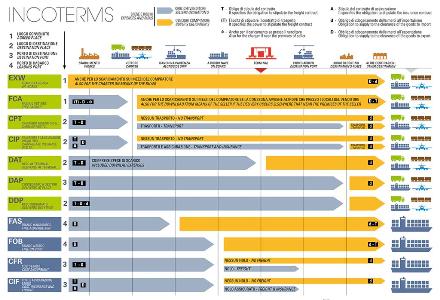

International Commercial Terms, in short

known as Incoterms and also known as 'terms of delivery' or 'shipping

terms' or 'trade terms' or 'infoterms' helps overcome these challenges.

Shipping terms are integral part of any export-import transactions

between exporter and importer.

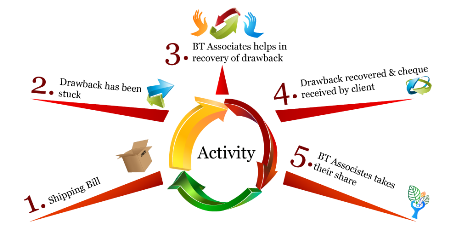

Duty drawback is a refund of taxes and duties paid either at the time of imports of goods meant for export in the same form or after use or as import duty paid on inputs to be used in exportable products.

For an Indian exporter's point of view,

the Goods and Services Tax (GST) has become some important area as

Indian exporters are finding out lot of issues related to working

capital deployment in export chain and raised this issues at various

levels.

Management of international payments to

ensure full and on-time payments, Letter of Credit and implication of

UCP-600 rules.

Cost Reduction Approach. How to do more

export business with less money – Case study

Understanding FEMA Guidelines and Master

Directions of RBI relating to export Transactions.

Understanding change in valuation of

Foreign Currencies (USD, STG, YEN and EURO) and basics of Currency Risk

Managements to protect profit margin – Export-Import transactions.

Documentation in international trade is the backbone of any transaction. Incomplete documentation or faulty documentation leads to losses of many kinds specifically monetary loss and brand image hampering.

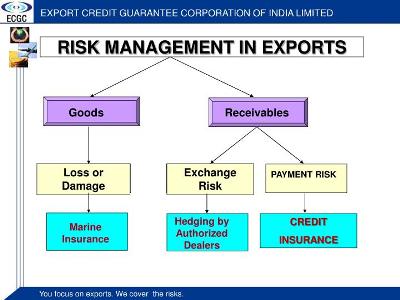

Export business has become very complex

and highly risky. Insolvency rate is on the increase. Balance of payment

difficulties have severely affected the capacity of many countries to

pay the import price.

Understanding Logistics Value Chain in Export operations

1. Introduction to the Programme: Overall Coverage and Assessing Export

Readiness

2. Background of India's Export

3. Harmonized System data Classification, Market Identification & Trade Map

4. Understanding the Market Opportunities

5. DGFT, Export Promotion, Role of RA, EPCs and RCMC;IEC

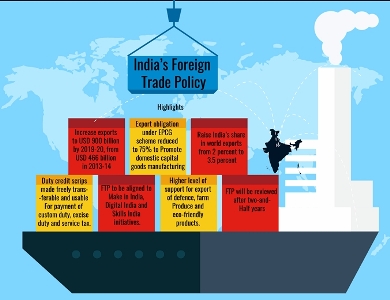

6. Foreign Trade Policy (2015-2020)

7. Foreign Trade Agreements

8. Non Tariff Barriers

9. Export Business Plan

10. Incorporating Incoterms 2010 in Trade Transactions

11. Duty Drawback and Claim Procedure

12. Implication of GST in Export Chain

13. Management of international payments to ensure full and on-time

payments, Letter of Credit and implication of UCP-600 rules.

14. Export Finance Bank Schemes

15. Understanding FEMA Guidelines and Master Directions of RBI relating to

export Transactions

16. Currency Risk Managements

17. COMMERCIAL& REGULATORY DOCUMENTS FOR EXPORT PREPARATION AND HANDLING

18. RISK MANAGEMENT IN EXPORTS – ROLE OF ECGC

19. Understanding Logistics Value Chain in Export operations

20. Importance of Packaging in Exports

* A total of users have registered for taking this programme. *

# A total of times this site has been accessed by the registered users. #

Copyright © 2018 - All Rights Reserved - Indian Institute of Foreign Trade

Designed / Developed / Hosted by Computer Center, IIFT